Hsmb Advisory Llc Can Be Fun For Everyone

Table of ContentsThe Facts About Hsmb Advisory Llc UncoveredUnknown Facts About Hsmb Advisory LlcAll about Hsmb Advisory LlcAll About Hsmb Advisory LlcIndicators on Hsmb Advisory Llc You Should KnowThe Only Guide to Hsmb Advisory Llc

Ford claims to avoid "cash money value or permanent" life insurance policy, which is more of an investment than an insurance policy. "Those are extremely made complex, come with high commissions, and 9 out of 10 people do not require them. They're oversold since insurance coverage agents make the largest commissions on these," he states.

Special needs insurance coverage can be pricey, however. And for those who decide for lasting treatment insurance coverage, this policy may make impairment insurance policy unneeded. Learn more regarding long-lasting care insurance and whether it's ideal for you in the following section. Long-term care insurance policy can help spend for costs associated with long-term care as we age.

How Hsmb Advisory Llc can Save You Time, Stress, and Money.

If you have a persistent health and wellness issue, this kind of insurance policy can end up being essential (Insurance Advisors). Nevertheless, don't allow it emphasize you or your financial institution account early in lifeit's usually best to obtain a policy in your 50s or 60s with the expectancy that you will not be using it till your 70s or later on.

If you're a small-business proprietor, take into consideration safeguarding your livelihood by purchasing organization insurance policy. In case of a disaster-related closure or period of restoring, organization insurance can cover your earnings loss. Take into consideration if a significant weather occasion influenced your store or manufacturing facilityhow would certainly that affect your income? And for the length of time? According to a record by FEMA, between 4060% of small companies never reopen their doors adhering to a calamity.

Plus, making use of insurance could in some cases cost greater than it saves over time. If you obtain a chip in your windscreen, you may think about covering the fixing expenditure with your emergency cost savings instead of your automobile insurance policy. Why? Since utilizing your auto insurance can trigger your monthly costs to increase.

Some Ideas on Hsmb Advisory Llc You Should Know

Share these suggestions to safeguard enjoyed ones from being both underinsured and overinsuredand speak with a relied on specialist when required. (http://peterjackson.mee.nu/do_you_ever_have_a_dream#c1981)

Insurance that is acquired by an individual for single-person protection or coverage of a family members. The specific pays the costs, as opposed to employer-based medical insurance where the company frequently pays a share of the costs. Individuals might purchase and purchase insurance from any type of plans offered in the individual's geographic area.

Individuals and family members may receive economic support to lower the expense of insurance policy costs and out-of-pocket expenses, however only when enrolling through Link for Health And Wellness Colorado. If you experience specific modifications in your life,, you are eligible for a 60-day duration of time where you can enroll in a private plan, also if it is outside of the yearly open registration period of Nov.

Hsmb Advisory Llc Fundamentals Explained

- Link for Health And Wellness Colorado has a complete checklist of these Qualifying Life Occasions. Dependent children that are under age 26 are qualified to be consisted of as relative under a parent's coverage.

It might seem simple yet recognizing insurance types can also be puzzling. Much of this complication originates from the insurance market's continuous objective to design individualized insurance coverage for insurance holders. In designing flexible policies, there are a variety to pick fromand every one of those insurance policy kinds can make it hard to recognize what a particular plan is and does.Hsmb Advisory Llc Fundamentals Explained

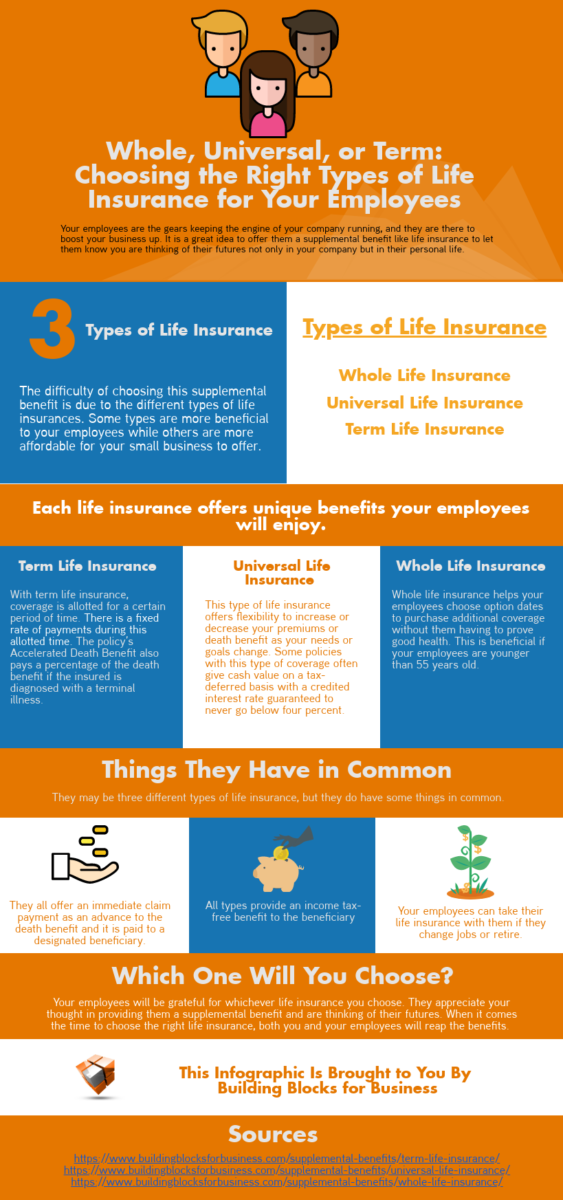

The most effective location to begin is to talk about the distinction in between the two sorts of fundamental life insurance policy: term life insurance policy and irreversible life insurance. Term life insurance is life insurance policy that is only active for a time duration. If you die during this period, the person or people you've named as beneficiaries might get the cash money payment of the plan.

Lots of term life insurance plans allow you convert them to an entire life insurance coverage policy, so you do not lose protection. Normally, term life insurance policy premium settlements (what you pay per month or year right into your policy) are not secured in at the time of purchase, so every five or ten years you own the policy, your costs might increase.

They additionally tend to be cheaper total than entire life, unless you purchase a whole life insurance policy when you're young. There are also a few variations on term life insurance. One, called group term life insurance policy, is common among insurance coverage options you may have access to via your company.The Ultimate Guide To Hsmb Advisory Llc

One more variation that you may have access to through your company is extra life insurance policy., or funeral insuranceadditional insurance coverage that could assist your family members in case something unanticipated happens to browse this site you.

Permanent life insurance coverage simply refers to any kind of life insurance plan that does not end.